At Mojo Homes, we understand that starting the journey towards your dream home can be both overwhelming and exciting, especially if it's your first time. This guide is divided into three sections: preparing financially for homeownership, understanding the current property market, and highlighting the significant costs to consider when purchasing or building property in NSW.

Preparing financially for buying property in NSW

Research the market

Starting your property search with market research is a great first step, but where do you begin? A crucial question to ask yourself initially is whether you prefer to build or buy a home for personal residence or investment purposes. Having a clear objective like this can streamline the research process and give you a better understanding of your desired location. Through research, you can:

- Gain insights into preferred locations

- Understand recent market trends in the area

- Assess affordability based on your preferences

Use online resources, consult real estate agents, seek advice from home purchasing experts, attend property inspections, and explore available options in and around your local area.

Determine your borrowing capacity

In the early stages of preparing to buy a house, it's crucial to assess how much you can borrow. This helps you identify properties that fit your budget and those that don't. Factors influencing your borrowing capacity include:

- Income and financial commitments such as rent, utilities, insurance, loan repayments, and tax bills

- House deposit and additional savings

- Credit score and credit report

To get started, you can use the Borrowing Power Calculator on our website, which provides an estimate and examples based on your income, expenses, and loan details.

Manage your debts

Clearing any outstanding debts, such as car loans or credit cards, before purchasing or building your first home is beneficial in the long run. Managing your debts offers the following advantages:

- Enhances your borrowing power

- Saves on interest

- Strengthens your home loan application

While saving for a house may be challenging, getting your debts under control is one effective way to expedite the process.

Create a budget and set savings goals

Regardless of the type of home you aspire to own, saving for a house deposit is necessary. Having a clear savings goal serves as a great motivator, preventing unnecessary spending and enabling you to allocate your hard-earned money towards your deposit. Establishing a budget to set aside funds weekly or monthly helps determine the amount you can save for your deposit.

A budget acts as a framework for tracking every expense, and not having one can lead to challenges while working towards your future home.

Explore home loans options

When searching for the best home loan deal, keep in mind that the interest rate plays a crucial role. Since a home loan is a long-term commitment, it's essential to find one that suits your situation and allows for comfortable mortgage repayments. At this stage, consider the following:

- Compare home loan rates and reach out to at least two different lenders to explore personalised loan options based on your circumstances. Even a slight difference in rates, such as lower than 0.5%, can lead to substantial savings in the long run

- Engage a mortgage broker to assist you in finding suitable home loan options

- Obtain pre-approval to purchase. Lenders can pre-approve a loan if you provide evidence of your current financial situation to assess your ability to repay the loan

Finding the right loan for your build can be challenging, and that's why MyChoice Home Loans is here to help by removing the stress of finding your finance. As experts in construction finance, the MyChoice team can assist you with finding the best lender to service your build.

Pick the right builder

Selecting the right builder is a critical step to consider before embarking on the journey of building your own home. Constructing a house is a lengthy process that requires careful consideration when choosing a builder. Here are some important factors to keep in mind and why Mojo Homes is an excellent choice:

Credentials: With over 35 years of experience in building homes for NSW residents, Mojo Homes is backed by the NEX Building Group, providing a solid foundation of expertise and industry knowledge

Customer Care: At Mojo Homes, we prioritise customer satisfaction and aim to create not just a home but a thriving community. Our commitment is demonstrated through our warranties, and a remarkable 25-year structural guarantee, ensuring the long-term durability of your home

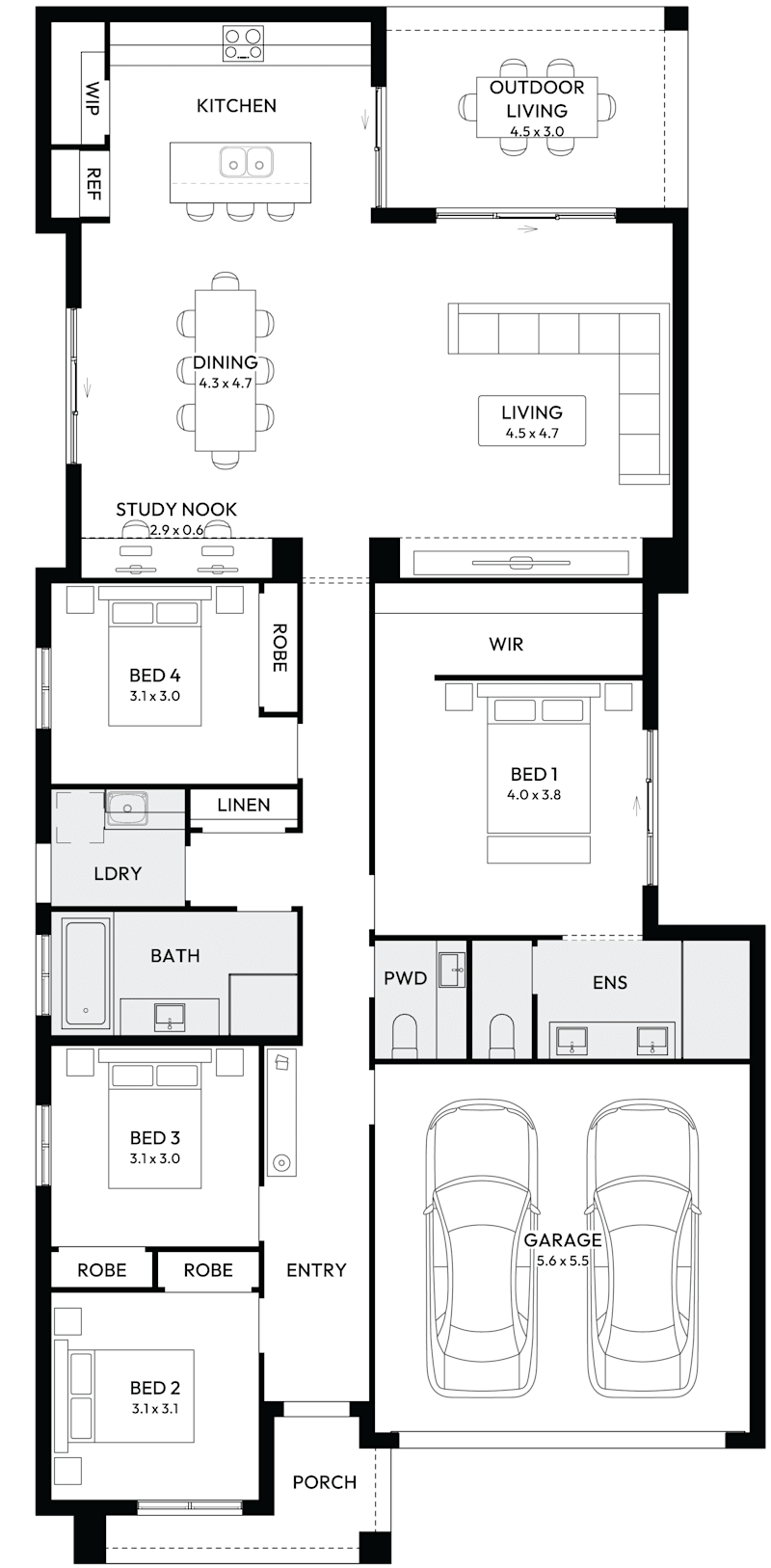

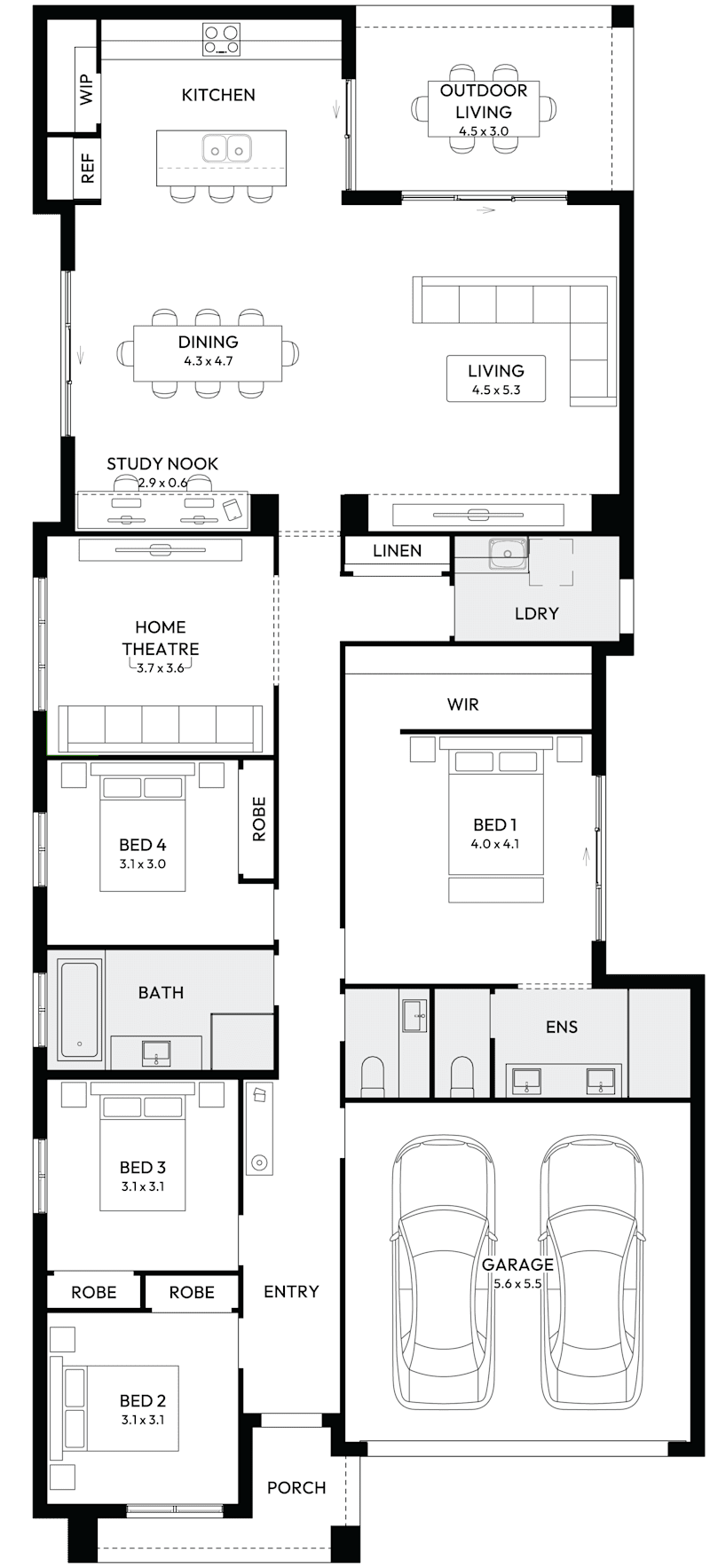

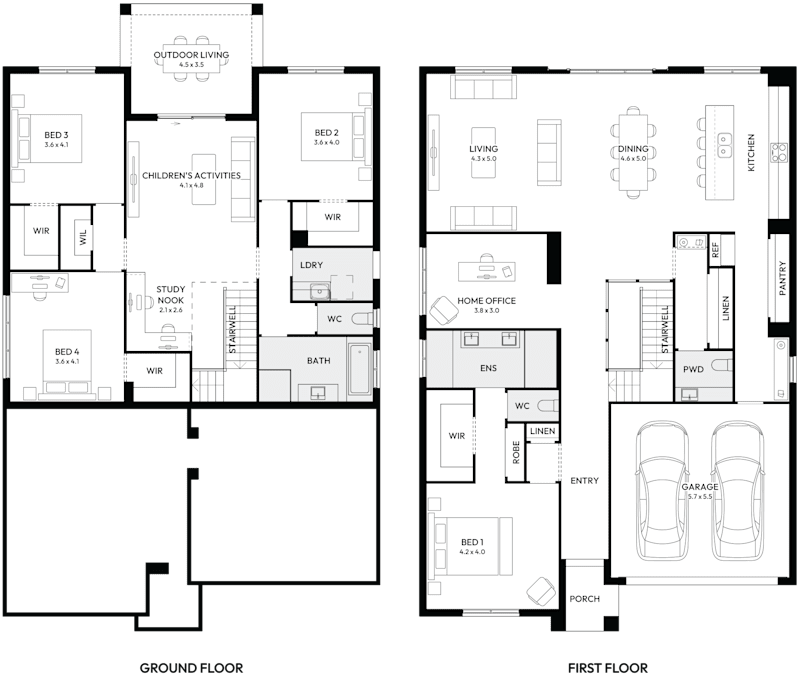

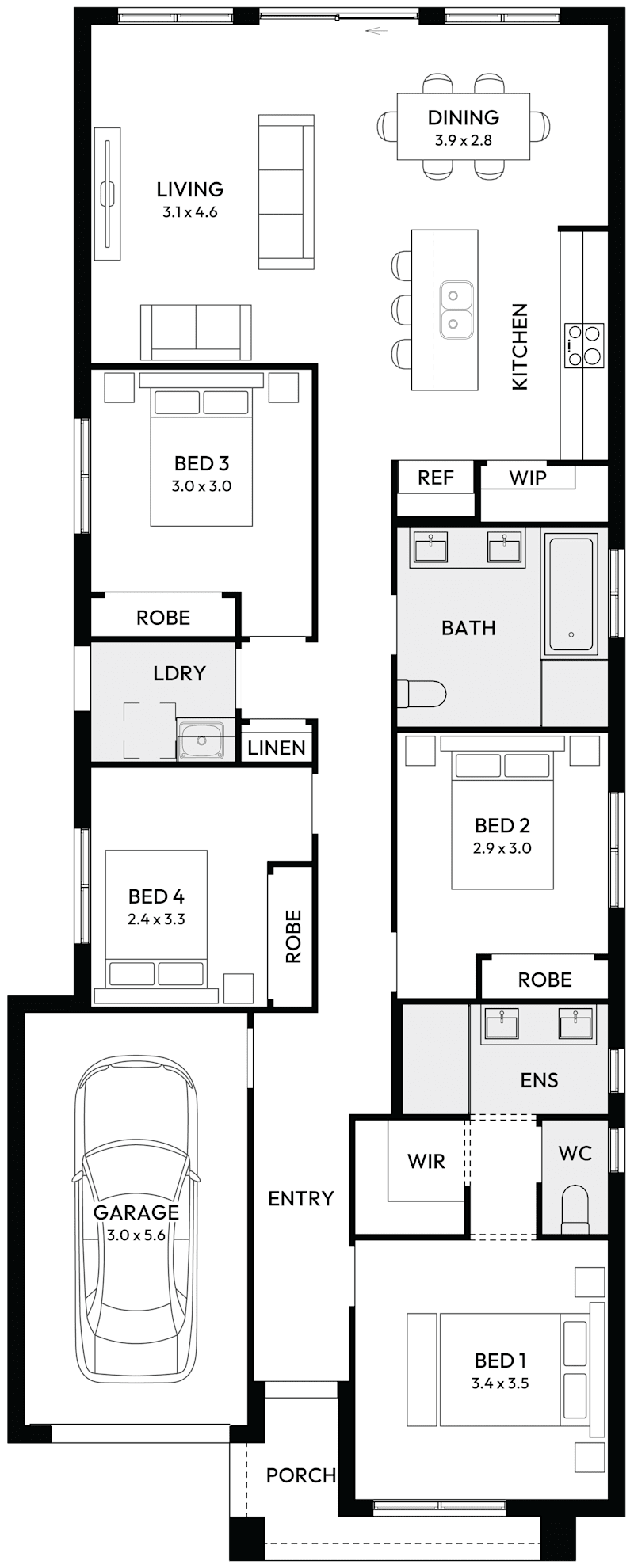

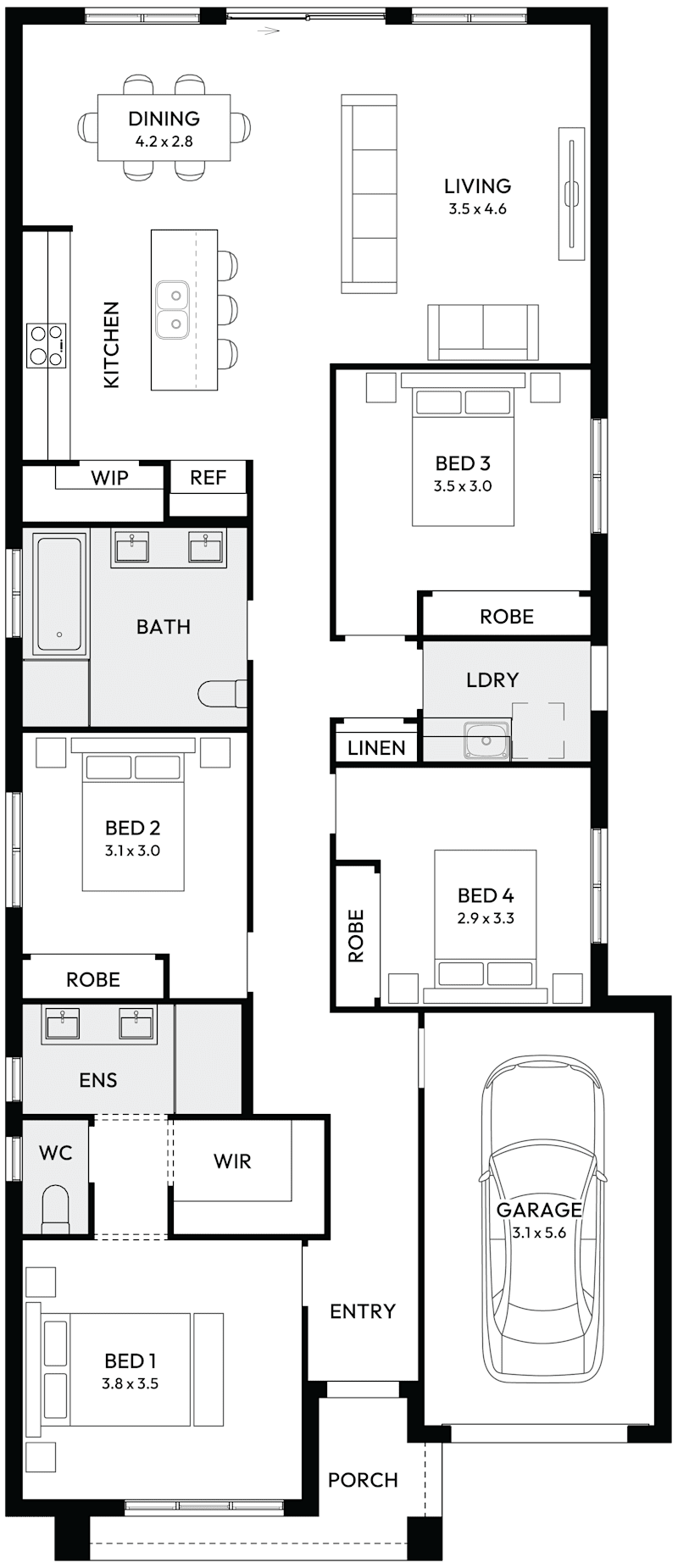

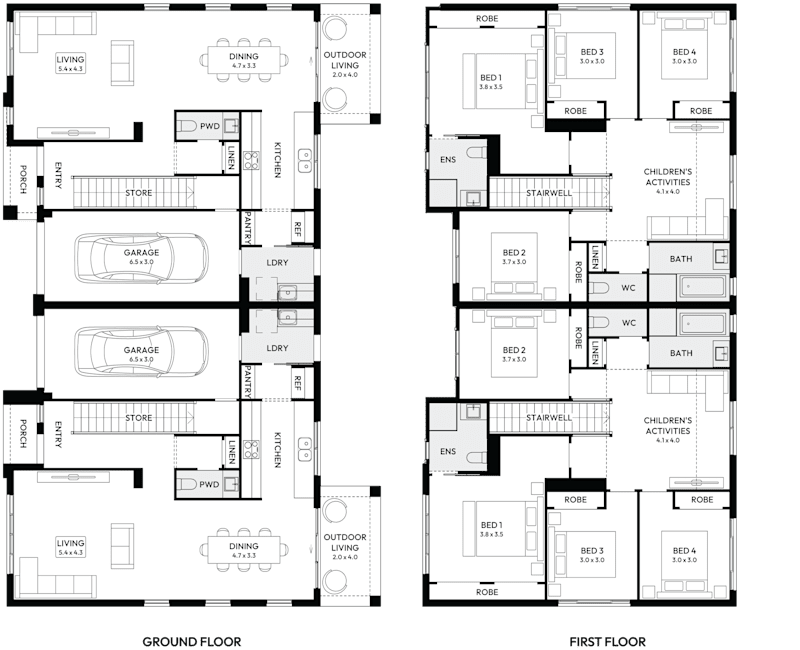

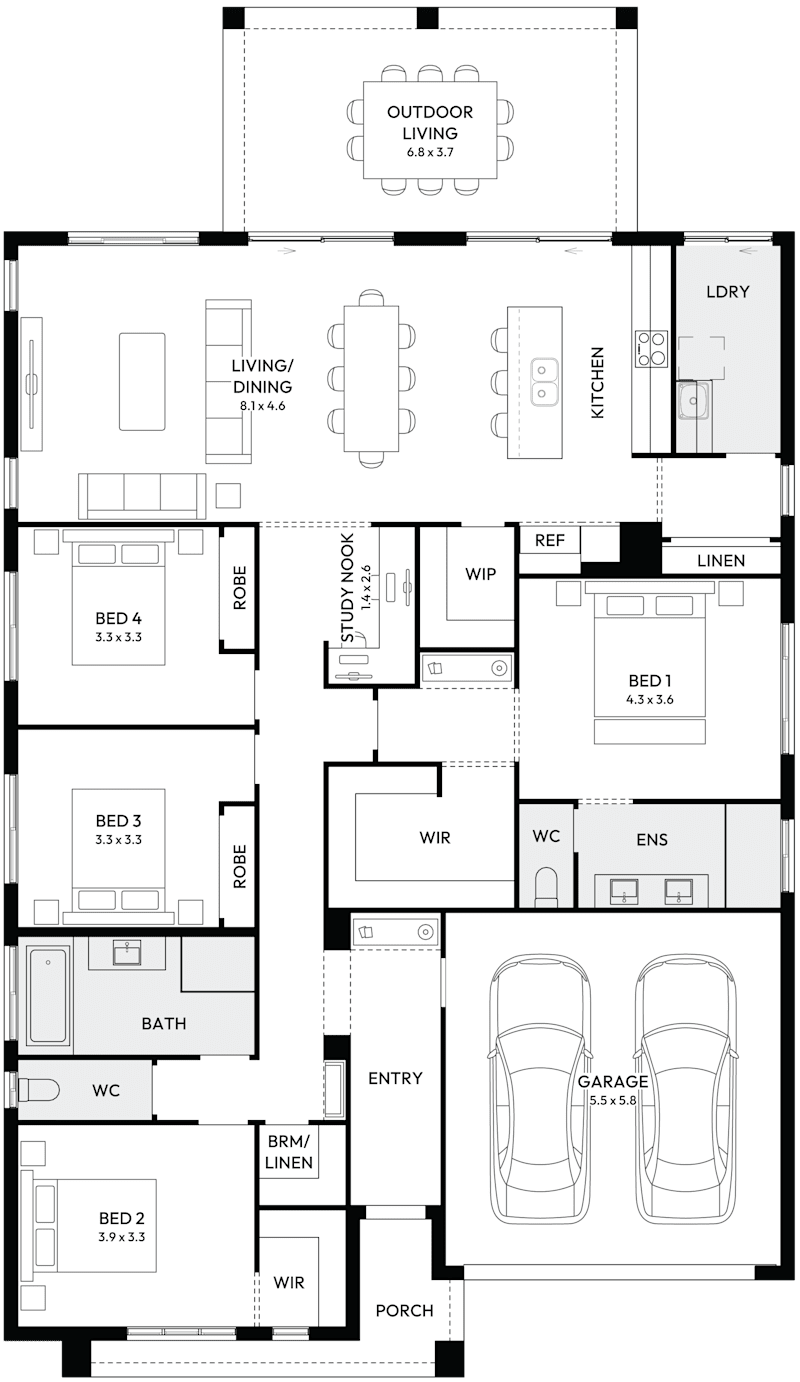

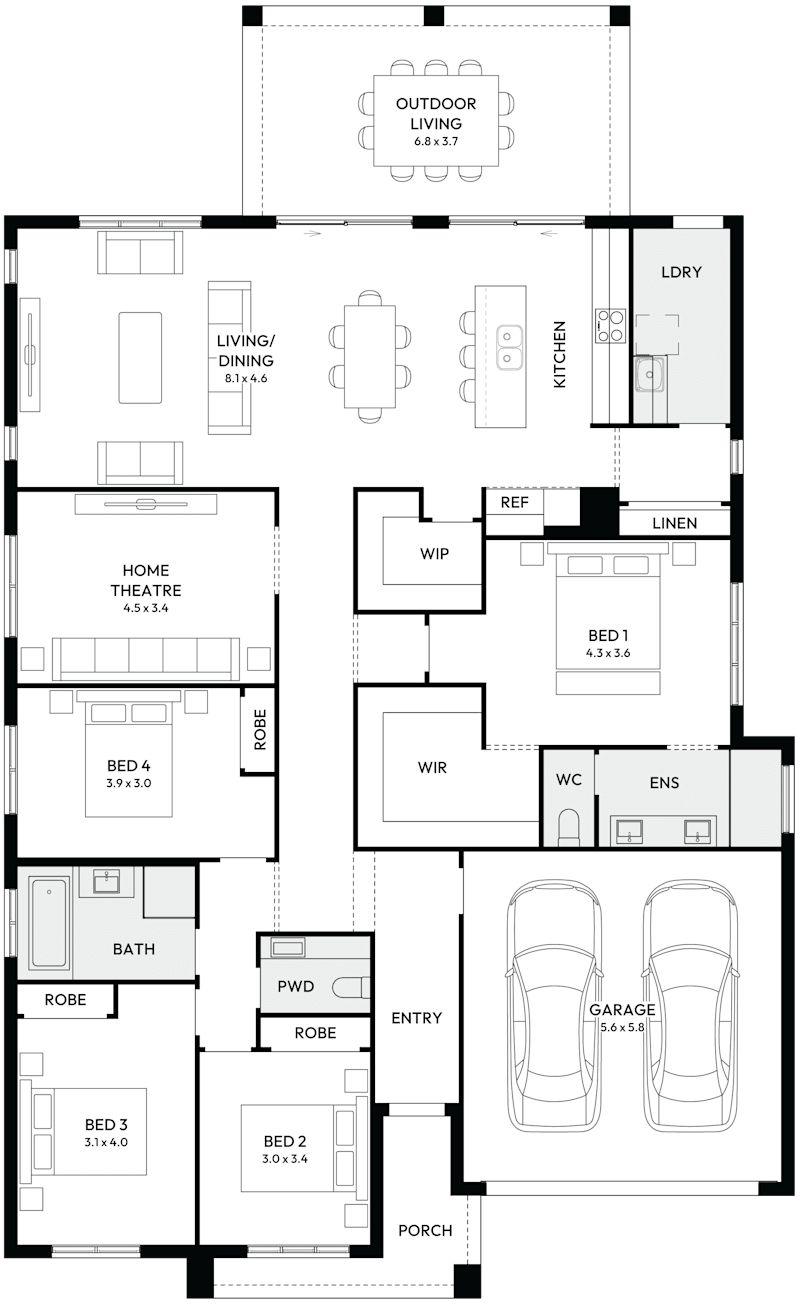

Building Style: Each builder has its own unique design style. At Mojo Homes, we offer a range of home designs that showcase our distinctive craftsmanship. Explore our portfolio to witness the exceptional quality and attention to detail that we bring to our projects